Over the next few weeks, Voyage Control will publish a blog series with a focus on ESG, introducing the topic and highlighting some of the key things to consider for businesses keen to broaden their understanding and improve ESG performance. Voyage Control is not an ESG specialist or provider of expertise, but it is something that we are passionate about and keen to help see widespread adoption of ESG strategies in the industries we work in. Following this first release in our three-part ESG series includes “How Does ESG Bring Value To Your Business?”, and “ESG Reporting Frameworks: What Are They?”. We are hoping this series will allow us to share resources we have found useful when exploring this important topic.

This first edition: “What is ESG, and Why Is It Important?” will be looking at just that. We want to lay out what ESG is, where the term originates, and how it can benefit your business operationally and financially.

ESG stands for ‘Environment, Social and Governance’ and is often used by companies and investors to better understand the potential impact on society and the planet. Many may know of ESG as Corporate Social Responsibility (CSR), ‘Sustainability’, ‘Socially Responsible Investing (SRI)’, or ‘Green/ Ethical Investing’. The term ESG was first used in 2006 when the United Nations (UN) launched the Principles for Responsible Investment (PRI). Signatories of the PRI are bound to follow six principles that demand the incorporation, disclosure, and promotion of ESG issues. However, the term itself didn’t enter the broader vernacular until the arrival of the 2015 UN Sustainable Development Goals which caused ESG to be the first voluntary link between that of sustainability and financial services (Beckett, O. & Ross, J. 2021).

In a letter to CEOs, Larry Fink, Chairman and CEO of BlackRock discusses many topics, one of which focuses on ‘Capitalism and Sustainability’, where he states that it is his belief that “the decarbonizing of the global economy is going to create the greatest investment opportunity of our lifetime.” He goes on to mention that “It will also leave behind the companies that don’t adapt, regardless of what industry they are in. And just as some companies risk being left behind, so do cities and countries that don’t plan for the future” (Fink, L. 2022). Following this announcement from BlackRock, Fink’s letter has become a catalyst for the shifting discussions that revolve around the improvement of ESG standards throughout businesses.

The climate crisis and COVID-19 pandemic have also acted as a huge catalyst for mainstreaming ESG, as it highlighted some of the global social and environmental challenges we currently face.

This has led to increased investor interest in companies that display good ESG practices. Research conducted by Ernst & Young (EY) shows that since the events of the COVID-19 pandemic, “90% of investors attach greater importance to companies’ ESG performance when it comes to their investment strategy and decision-making” (Nelson, M. 2021). However, EY finds that about 49% of companies have updated their ESG investment approaches, while simultaneously showing that “ESG risk has become an even more important part of investment decision-making and portfolio construction, with close to three-quarters (74%) saying that the COVID-19 pandemic has made them more likely to divest based on poor ESG performance” (Nelson, M. 2021).

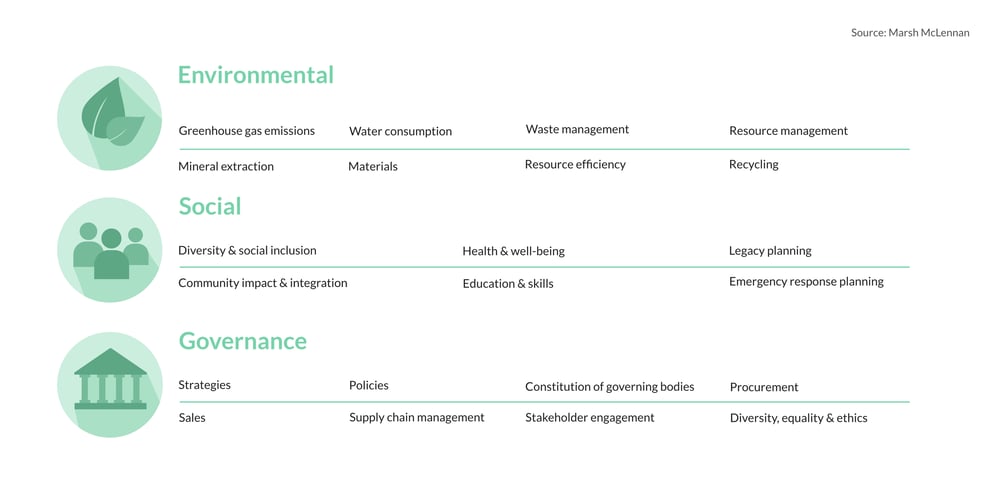

Examples of ESG awareness and operations may include the way the company operates through efficiently managing water, energy, and wastage levels. It can also include how a company gives back to the community and society that it operates in, including its employees, and how it governs itself. By creating and following certain charters or credentials about positive ESG practices, companies can ensure they are making the right business decisions and aren’t engaging in practices that negatively affect the planet, people, and the environment they operate in.

Within each industry, there will be different ESG considerations – for some, water management will be the top priority, but for others, data security will trump this. Businesses need to conduct a materiality assessment to understand where they can maximize their ESG performance.

Materiality is known as the principle of defining the social and environmental topics that matter most to one’s business and stakeholders. The idea is, a “materiality assessment should be used as a strategic business tool, with implications beyond corporate responsibility (CR) or sustainability reporting” (KPMG, 2014). Through the use of materiality assessments, KPMG outlines some of the many benefits that this strategic tool provides businesses to better their ESG scoring. Many of these include applying a sustainability lens to business risk, opportunity, trend-spotting, and enterprise risk management processes. Other benefits of materiality assessments include, but of course, are not limited to:

- Ensuring business strategies take account of significant social and environmental topics and managing sustainability issues embedded in business processes.

- Identifying future trends like water scarcity or changes in weather patterns.

- Prioritizing the organization’s resources for the sustainability issues that matter most for the business and stakeholders, to focus time and money on the most important topics.

These are just a few of the many benefits that such business assessments can provide, however, as “there is no one universally agreed definition or approach for determining material topics, leaving companies free to develop their own approach” (KPMG, 2014).

ESG considerations often differ from industry to industry and for the construction industry, this can be seen in Figure 1 (Kelly, D. 2021).

[FIG. 1]

These are some of the many considerations that the construction industry needs to have to maintain positive ESG practices and having “an effective ESG framework in construction will seek to identify and measure such factors so that it can improve environmental awareness throughout the industry and encourage more sustainable design and operational choices” (Kelly, D. 2021).

An effective ESG framework will seek to identify and measure factors so that it can improve environmental awareness throughout many industries and encourage more sustainable design and operational choices. Some industries like construction will also be challenged to minimize the use of resources and generation of waste, seek opportunities for recycling and reuse, and embed circular economy concepts within design solutions. This growing list of challenges moreover emerges against a backdrop of tightening safety standards and growing economic constraints. However, these challenges simultaneously present opportunities for countless companies to demonstrate innovation, sustainability, and a “best-in-class” quality – all of which can lead to a greater competitive advantage and stronger economic growth.

With the discussion of ESG performance increasing across many industries, the awareness of the topic and how companies intend on improving their practices continues to improve. This is a discussion that Voyage Control is very excited to explore throughout this blog series. Come back next month where we will be diving further into the discussion about ESG and its effects on the supply chain, along with how ESG plays a role in the success of businesses in the article ‘How Does ESG Bring Value To Your Business?’

Written by: Adrian Sakellaris / April 4th, 2022

If you're interested in learning more, please contact us at info@voyagecontrol.com

References List:

- Kelly, D. (2021). Exploring the Impact of ESG on Contractors. Marsh McLennan.

- Beckett, O. & Ross, J. (2021). ‘ESG’ Investing: What Is It, Where are We Now, Where Is It Going? Janus Henderson Investors.

- Greenhouse Gas Protocol. (2013). Technical Guidance for Calculating Scope 3 Emissions.

- Paraskova, T. (2021). Supply Chain Needs $100 Trillion To Become Net-Zero By 2050. Oilprice.com.

- KPMG International. (2014). Sustainable Insight: The Essentials of Materiality Assessment.

- Nelson, M. (2021). Is Your ESG Data Unlocking Long-Term Value? EY.

- Fink, L. (2022). Larry Fink’s 2022 Letter to CEOs: The Power of Capitalism. BlackRock.