Most global industries operate well-established supply chains with reliable expertise and capabilities. However, the construction industry remains behind the pack, which was exemplified due to the global COVID-19 pandemic. On Wednesday, November 9th from 14.00 CST, the CEO of Voyage Control - James Swanston presents insights into what may result over the next 12+ months along with how owners and contractors may regain a stronger hold over their supply chain challenges.

This two-part series looks to explore some of what James will be discussing at the 2022 Groundbreak conference. This first article will focus on the problems that the greater construction industry and supply chain has been facing over the last two years. The second article explores ways in which these problems can be solved, improved upon, and more.

Historically, the construction industry has been renowned for many impressive accomplishments from creating increasingly high cityscapes to bringing essential city-building infrastructure to fruition and revolutionizing construction materials to be stronger, more reliable, more cost-effective, and now more environmentally sustainable. However, the industry faces many dismal flaws that hold itself back from improving and growing. One part of this is the lacking adoption of digitized systems, since “digitization is lower than in nearly any other industry” and as a result, “customer satisfaction is hampered by regular time and budget overruns and lengthy claims procedures” (McKinsey & Co. 2020).

COVID-19’s Effect on the Construction Industry

From late 2019 to now, the industry has been reeling from the economic impact that the COVID-19 pandemic laid upon the wider construction ecosystem, as the pandemic has reduced demand in some markets, disrupted the supply chain, competition intensified and performance weakened due to staff and skilled labor shortages (Kelly, A. 2022). As a result, a perfect storm of factors was created including “lockdowns, workplace restrictions, border closures, and natural disasters have caused significant interruptions in the production and manufacturing of building materials in both domestic and international supply chains” (Cotter, B & Zhang, K. 2021).

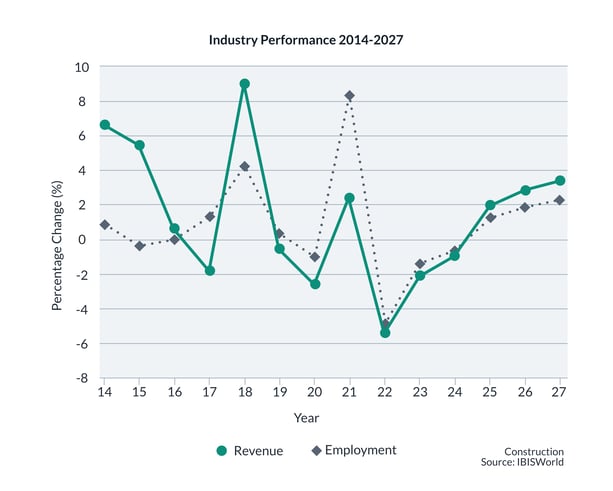

Restrictions to contain the pandemic have required construction firms to change their worksite practices to comply with social distancing and workplace hygiene. Over the next 5 years, demand is projected to steadily improve for the industry, however, the “industry’s short-term prospects are forecasted to deteriorate due to the winding down of government stimulus spending as the economy emerges from the effects of the COVID-19 pandemic” (Kelly, A. 2022). Other reasons for the deterioration in the industry include the present instability of the global economic and financial markets. This instability results in an increased discouragement of foreign and local investments in the commercial property market. As can be seen from the below graph (Industry Performance 2014-2027), construction in Australia has seen a drastic decrease in revenue from 2018 to 2022 with a spike in 2021, to then drop again between 2021/2022. As seen on the same graph, employment data follows the revenue trends as they’re both projected to steadily increase over the next 5 years (Kelly, A. 2022).

Restrictions to contain the pandemic have required construction firms to change their worksite practices to comply with social distancing and workplace hygiene. Over the next 5 years, demand is projected to steadily improve for the industry, however, the “industry’s short-term prospects are forecasted to deteriorate due to the winding down of government stimulus spending as the economy emerges from the effects of the COVID-19 pandemic” (Kelly, A. 2022). Other reasons for the deterioration in the industry include the present instability of the global economic and financial markets. This instability results in an increased discouragement of foreign and local investments in the commercial property market. As can be seen from the below graph (Industry Performance 2014-2027), construction in Australia has seen a drastic decrease in revenue from 2018 to 2022 with a spike in 2021, to then drop again between 2021/2022. As seen on the same graph, employment data follows the revenue trends as they’re both projected to steadily increase over the next 5 years (Kelly, A. 2022).

Restrictions to contain the pandemic have required construction firms to change their worksite practices to comply with social distancing and workplace hygiene. Over the next 5 years, demand is projected to steadily improve for the industry, however, the “industry’s short-term prospects are forecasted to deteriorate due to the winding down of government stimulus spending as the economy emerges from the effects of the COVID-19 pandemic” (Kelly, A. 2022). Other reasons for the deterioration in the industry include the present instability of the global economic and financial markets. This instability results in an increased discouragement of foreign and local investments in the commercial property market. As can be seen from the below graph (Industry Performance 2014-2027), construction in Australia has seen a drastic decrease in revenue from 2018 to 2022 with a spike in 2021, to then drop again between 2021/2022. As seen on the same graph, employment data follows the revenue trends as they’re both projected to steadily increase over the next 5 years (Kelly, A. 2022).

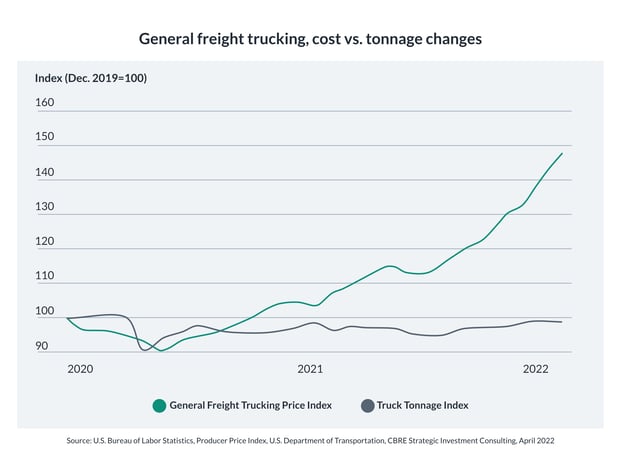

The same can be seen in the U.S. as labor shortages in rail yards, manufacturing plants, warehouses, and trucking companies are “exacerbating delays at U.S. seaports”. As noted in a report by CBRE (2022), the American Trucking Association reported in October of 2021 that the industry is short roughly 80,000 drivers and are expecting to increase its driver count to 130,000 by 2030. For this, the sector has started increasing wages to incentivize an influx of new drivers, however, barriers to entry like licensing remain an obstacle for the sector to respond quickly to the demand.

The same can be seen in the U.S. as labor shortages in rail yards, manufacturing plants, warehouses, and trucking companies are “exacerbating delays at U.S. seaports”. As noted in a report by CBRE (2022), the American Trucking Association reported in October of 2021 that the industry is short roughly 80,000 drivers and are expecting to increase its driver count to 130,000 by 2030. For this, the sector has started increasing wages to incentivize an influx of new drivers, however, barriers to entry like licensing remain an obstacle for the sector to respond quickly to the demand.

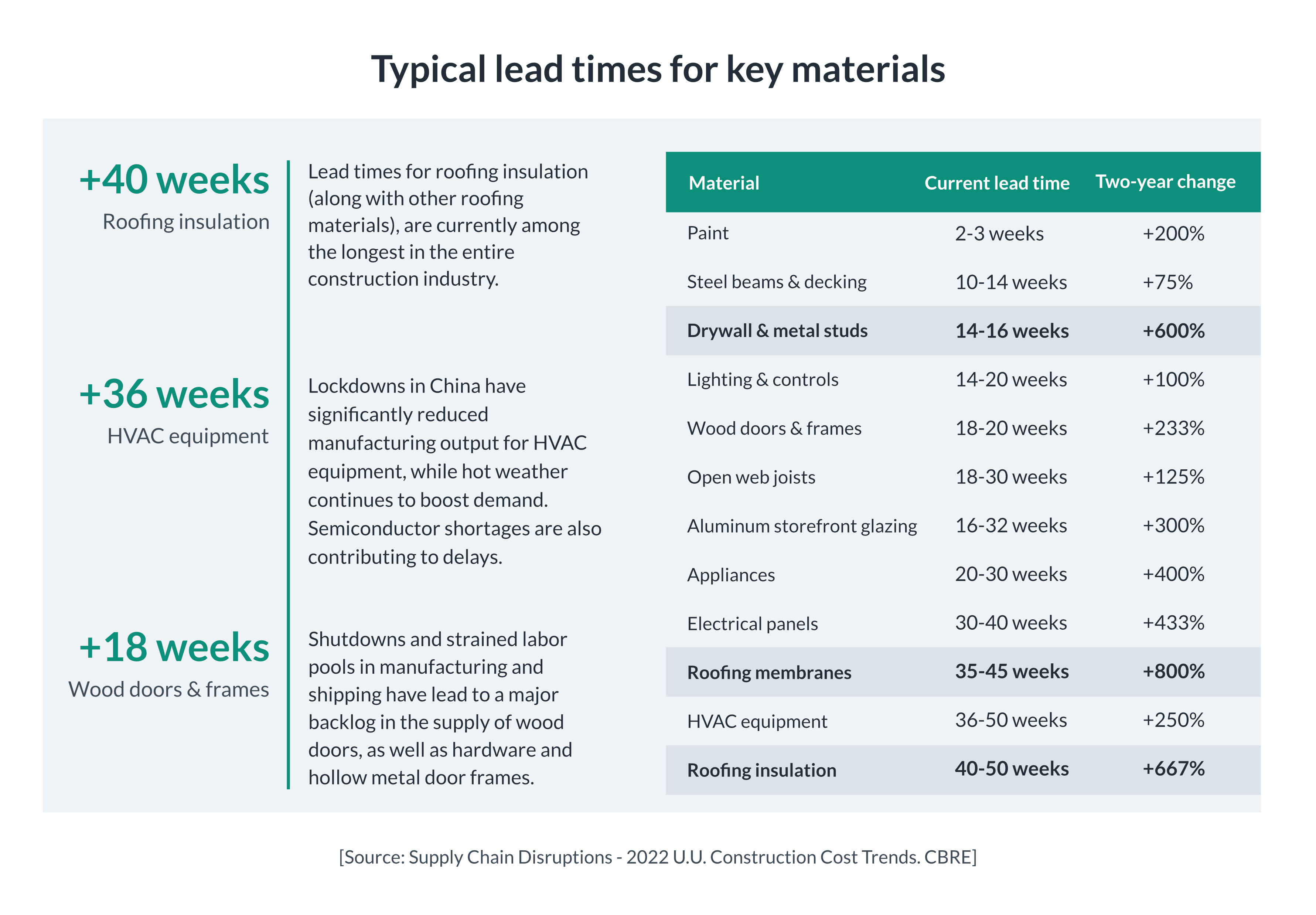

As many global problems continue to affect the supply chain, these “issues [continue to] affect all aspects of building projects, not just core and shell construction. It’s now a much tighter and more diligent process to ensure all items are being ordered and tracked” (Hay, S. 2022). Due to the effects of COVID and other global issues, the exacerbation of lead times are forcing elongated wait times on important building materials, which thus result in increased project delays and heightened financial spending.

Hay (2022) refers to this as the need to rethink the way contractors and companies understand the logistics behind the supply chain. An example he uses includes when ordering plywood made in the U.S. Even though the plywood may be made in the States, the resin used to bind the wood may not be and needs to be shipped to the U.S, which then delays the whole process. This can be seen in the below graph as typical lead times for materials are exacerbated beyond their pre-pandemic levels (CBRE, 2022).

With the manner in which the construction industry supply chain is operating, there are a number of ways in which actions need to be taken in order to aid in future improvements. As part of James Swanston’s presentation at Procore’s 2022 Groundbreak panel, James will be focusing on ways to stay ahead of the supply chain crunch in the construction industry. To find out more about James’ presentation, all information can be found here.

With the manner in which the construction industry supply chain is operating, there are a number of ways in which actions need to be taken in order to aid in future improvements. As part of James Swanston’s presentation at Procore’s 2022 Groundbreak panel, James will be focusing on ways to stay ahead of the supply chain crunch in the construction industry. To find out more about James’ presentation, all information can be found here.

References:

- CBRE. (2022). Supply Chain Disruption: 2022 U.S. Construction Cost Trends.

- Cotter, B. & Zhang, K. (2021). Supply Chain Delays and Material Shortages in the Construction Industry. Hall & Wilcox.

- Gensler. (2022). Understanding Supply Chain Challenges and Opportunities in Design and Construction.

- Kelly, A. (2022). Construction in Australia. IBISWorld.

- McKinsey & Company. (2020). The Next Normal in Construction: How Disruption is Reshaping the World’s Largest Ecosystem.